The AI Race — Sprint or Marathon?

Posted on December 17, 2025

At various junctures in this 3-year investment cycle that unofficially began with ChatGPT’s launch in October 2022, the major US tech players have been both rewarded and punished for their runaway capex spending, as well as rewarded and disciplined when in commentary or actions, they have exhibited prudence in that same spending. This erratic market reaction function suggests it isn’t at all clear which strategic approach is the right one, ie; should corporate chieftains be conserving funds, as AI will eventually become a commoditized race to the bottom, or should they be going all-in in a market share land grab, regardless of the near-term impact to cash flows and leverage?

It could also be a function of the changing facts on the ground on a very dynamic field. For now, investors are rewarding modest spending, as well as some demonstration of disentanglement from the Nvidia (chips) /Oracle (dataserver) /OpenAI (AI model) ecosystem.

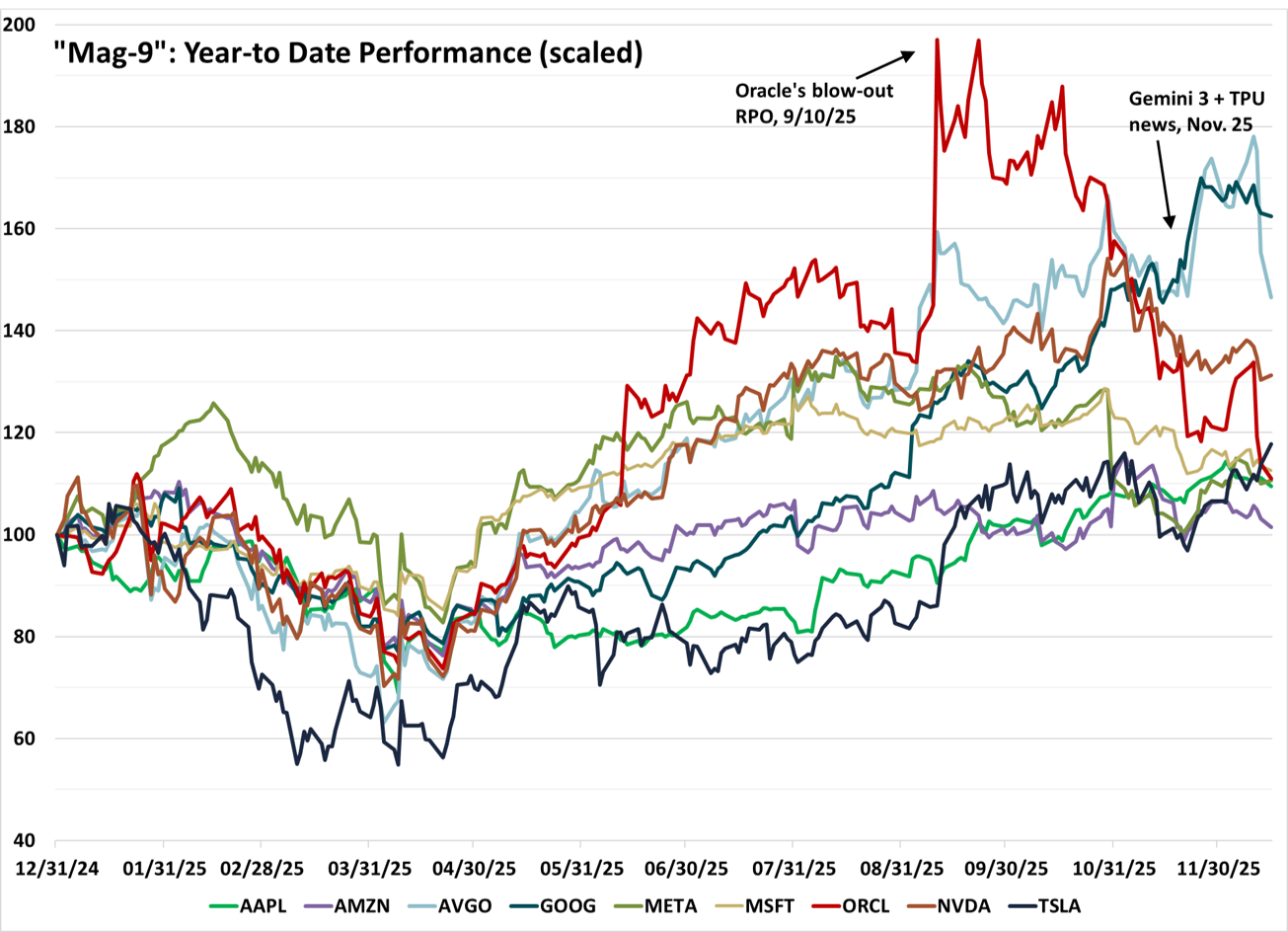

Exhibit 1: Who’s Winning? Depends on the Day

Source: FactSet, FTWM

Exhibit 1 plots the scaled 2025 price performance of the 9 companies at the epicenter of the AI revolution. Any of a number of them have led the group: in order over the year, Nvidia, Tesla, Meta (Facebook), Microsoft, Oracle, and most recently Alphabet (Google) and Broadcom (ticker: AVGO), have all been on top at one point, and were thought to be ascendant in their technologies or chips, or in their technology stack/adoption, or in driving their customers’ technology stack/adoption.

Oracle: AI Case Study in Hype vs. Reality

The experience of Oracle shares in Exhibit 1, especially from September 9 to today, could prove to be especially relevant to the broader tech space, and the broader market, and is worth reviewing in some detail.

Oracle has a statistic called its RPO, Remaining Performance Obligations, the aggregate sum of unbooked, but contractually committed, revenues in its future pipeline. In its September 9 quarterly release, Oracle announced a $332 billion increase in its RPO, within the quarter, to $455 billion. On September 10, the first day for the market to react to this stunning news, shares were up 36% for the day. The shock and awe of the RPO figure and the hyperbolic notion that AI spending was both limitless and without risk lasted for about a month, and has since been steadily supplanted by concerns over the expensive and expansive server buildouts needed to fulfill these contracts, the margins attached to this incremental business, possible bottlenecks and delays for these projects, questions over financing, and lastly, the health of its largest customer OpenAI (ChatGPT parent), later determined to be the source of $300 billion of the $332 billion RPO increase.

Oracle’s financial health and leverage, the worst among its large cap tech peer group, has triggered a larger rethink on debt loads and spending sustainability across the group, for whom we have also seen increased debt issuance. Meta (parent of Facebook, $30 billion bond offering in October), Amazon ($15 billion in November), and Alphabet (parent of Google, $25 billion in November), have all come to market over the past few months, and have also all seen their bonds meaningfully trade down after issuance. This is aside from the meaningful amount of off-balance sheet arrangements—operating leases and opaque “special purpose vehicles”—that are also gaining favor as a means of, in the companies’ view, risk- and economics-sharing, but in the view of some investors, a means to obscure the true financial leverage picture.

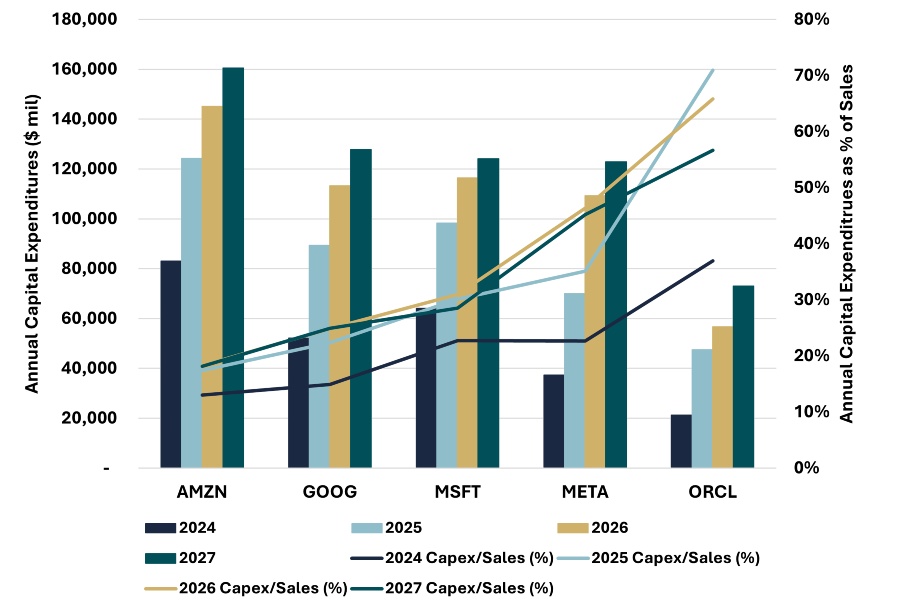

What cannot be obscured is the rapidly deteriorating cash flow picture at all of these companies, once touted for their capital-light business models. Exhibit 2 shows that both the capex spend in dollars, and as a percentage of each company’s sales, are at levels that are not sustainable, absent a similar stepwise move in bottom-line earnings. But currently those earnings, while very solid at an aggregate 19% YoY in 2025, are dwarfed when compared to the aggregate 67% YoY growth in capex.

Exhibit 2: Hyperscalers are hyper-spending

Source: FactSet, FTWM

Oracle’s troubles are symptomatic of a larger sector reckoning underway, and one that will likely persist until we receive hopefully improved guidance and better margins and cash flow, in 4Q25 earnings releases in January/February 2026. For now, we are left with an unflattering financial picture and emerging signs of investor impatience, not at all unreasonable given the separately high valuations.

Google & Gemini: A New Sheriff in Town

Unless, of course, there is an advancement in the large language models (LLMs) driving AI adoption, and with it a material shift in the growth and revenue trajectories of the key players Open AI (ChatGPT), Google (Gemini), Anthropic (Claude) – and that in fact is what has also occurred over the past few weeks. Gemini 3, powered by Google, was released in November, to great praise and scoring above ChatGPT 5 in several benchmarking tests, prompting Salesforce CEO Mark Benioff to exclaim, “I’ve used ChatGPT every day for 3 years. Just spent 2 hours on Gemini 3. I’m not going back.”

The prospects of Google chipping away at OpenAI’s once unassailable lead in the AI model and adoption race, coincided with equally positive news with respect to its in-house chip, Ironwood, which powers a good deal of its Gemini LLM. Google’s chip-design partner, Broadcom, also benefitted by association, under the thesis that Nvidia’s market share, and margins, may be declining from this type of competition in the near future. This risk was underscored a few days later when Meta was revealed to be in talks to also deploy Google’s chips in its servers by 2027.

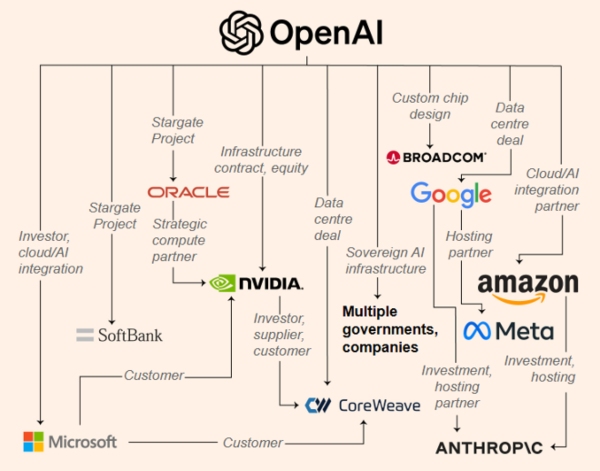

Exhibit 3: OpenAI/Nvidia/Oracle ecosystem being challenged

Source: FT, FTWM

As a proxy for OpenAI’s equity, which is privately held, one can observe the price movement for Japan’s SoftBank, among the largest single investors in OpenAI, whose shares are down over 40% over this period.

As Exhibit 3 illustrates, the degree of interconnectedness in the AI ecosystem is difficult to neatly separate, but the market has appeared to take the rough position, for now, that good news for Amazon, Broadcom, Google, and Meta, is bad news for Nvidia, OpenAI, Oracle, and Microsoft (another major OpenAI investor). OpenAI calling an internal “Code Red” a few days subsequent to the Google headlines seemed to confirm this is the view by the companies themselves.

The long-run AI race may indeed be a marathon with far-reaching geopolitical implications that will play out over decades. But given the stakes, the financial and intellectual firepower being brought to bear, and the speed of the technology and advancements, it may be best to consider it as a series of sprints. As noted, several companies have been winners along sections of the course this year. At Florida Trust Wealth Management, we have found it prudent to select those moments to reassess and rebalance, but ultimately, stay in the race.

Kristian R. Jhamb, MBA, CFA

Chief Investment Officer