Tariffs, the Fed, and Markets: Hard Hats Recommended

Posted on August 21, 2025

In 2025, the singular driving force behind market swings, first to the downside, then rebounding on a stunning rally, has been the scale and scope of the “uncertainty” surrounding the US’s tariff and trade policy. Just as relevant, is the unknown knock-on impact to consumers, corporations, and the economy. At the time of its initial unveiling on April 2, many questions abounded. At this point, we do have some answers, so we believe it’s appropriate to re-assess the current state of play and how it might impact markets and your portfolios.

Many Questions—Some Answers

• Would these shockingly high rates truly be imposed on our allies and largest trading partners? (Answer: Not on April 9, but 3 months later, mostly yes)

• Were these rates, and the methodology, just an opening negotiating stance, not intended to endure? (Answer: In some cases yes; in many others, no)

• Was the policy even legal, and could it survive challenges in the courts? (Pending)

• Could the corporate sector possibly navigate this? (Answer: Yes, by importing goods early, cutting hiring, and holding back on price hikes—so far.)

• What will be the overall impact to growth and inflation? (Answer: Lower; Higher)

Tariffs are Here to Stay (If Legal)—For Political, Geopolitical and Fiscal Purposes

It’s important to recognize that the stated goal of these measures was to achieve reciprocity in the treatment of U.S. exports in explicit tariff rates, and also in reaching some relenting of non-tariff inequities. Among the most commonly cited violators of trading norms is China, accused of intellectual property theft, illicit subsidies to its domestic producers, market barriers, transshipment games, and currency manipulation. In a geopolitical context, there had been growing recognition by the President that NATO-members (and non-NATO allies) may have been free-riding off the US security umbrella, while at the same time subjecting US corporates to less-than-open terms of trade, or in the case of our tech heavyweights, explicit digital taxes upon our best firms, seemingly simply for their success.

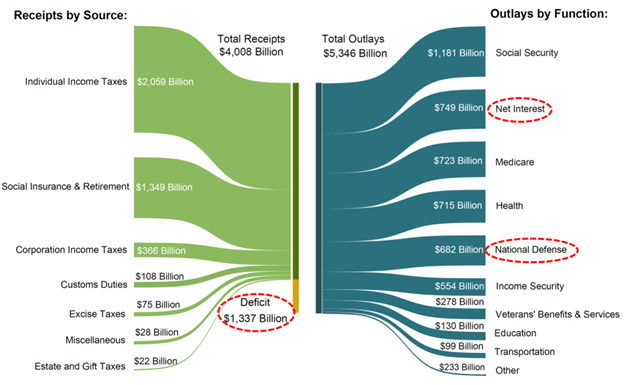

One thing that is reasonably certain, barring action on the legal front, is that tariffs are here to stay. The administration has repeatedly touted them as a continuing revenue source—perhaps $400 Billion in annualized collections (based on July’s customs and duties). Importantly, the US’s yawning deficit requires it (Exhibit 1).

Exhibit 1: US Fiscal Year-to-Date (9 mo): Cumulative Receipts, Outlays, Deficit

Source: US Treasury, FTWM Research.

Intersection With Geopolitics, Security

In the several months of multi-party discussions and deals that have spanned the globe, it’s also become clear just how much these trade discussions intersect with the geopolitical and security arenas. Some examples:

• In May, Saudi Arabia inked a deal to initially buy 18,000 Blackwell chips from market leader, Nvidia. This type of handoff in capital spending from corporate AI to “sovereign AI”, could keep profits and the AI theme ascendant in the US, and help the US achieve the “system lock-in” on AI standards—and would also be a necessary demand backfill should China be blocked from purchasing our leading-edge technology for national security reasons. It is also likely the reason the administration simultaneously rescinded the Biden-era “diffusion rule”—which would have imposed highly rigorous export restrictions on these chips, wherever they may transit, all over the world. So here, extreme “Liberation Day” terms gave way to commercial and geopolitical realities.

• Similarly for Apple—originally thought to be uniquely positioned as the loser in a US-China/India trade wars, given its reliance on Chinese manufacturing and Indian assembly for its devices—it also was given a reprieve. There may still be “Section 232” tariffs on electronics and semiconductors applied, but those are also expected to be a fairly light touch, if not an outright exemption. This has driven a good deal of its 15% move up in August.

• Or witness the remarkable pivot by the NATO nations, who, aside from just a few holdouts, have committed to spending a previously mocked 5% of GDP on defense by 2035. This commitment was certainly a factor in the EU’s parallel trade discussions with the US, which settled at a 15% tariff rate—better than many feared.

• China holds 70% of rare-earth production, and critically, 90% of rare-earth magnets. Its chokehold of these components in virtually all electronics, was an influence in the negotiations and drove some of the horse-trading, such as the US’s relenting on the sale of Nvidia chips in exchange for reopening rare earth exports.

Inflation? Nothing to See Here… Yet

Thus far, the inflationary impact from tariffs has been muted, “only” 3.1% in the latest core CPI reading. Whether that is a durable outcome is the key question confronting markets. The administration has declared victory over economists and forecasters, and has taken an increasingly hostile stance toward the Federal Reserve and its chair, Jerome Powell, culminating in an awkward photo op of the two of them on July 24, both donning hard hats while reviewing renovations at the Eccles Building, the headquarters for the Federal Reserve Board.

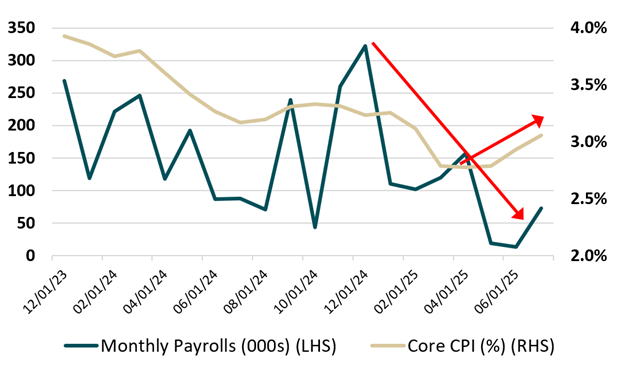

Powell has metaphorically been wearing a hard hat for the past several months, as he and his committee have been assailed for what has been viewed from the White House as overly restrictive monetary policy, given the relatively quiescent inflation figures. However, recent CPI, its inflation measure cousin, the PCE, and an alarming acceleration in producer prices (PPI), have cast that argument into some doubt (Exhibit 2).

A more compelling case may in fact be that the balance of risks—recall the Fed’s two sometimes countervailing mandates of full employment and price stability—weighs heavier on the side of a growth scare, which would merit rate cuts.

Exhibit 2: Inflation (CPI) and Labor (Payrolls), Moving in Opposite Directions

Source: FactSet, FTWM Research.

Growth Deceleration: Economy at Stall Speed

The recent alarm over a growth deceleration arose on August 1 with the release of July’s payroll numbers, as well as the revision axe taken to prior months’ figures, such that trailing 3-month job growth is an anemic 35K/month (Exhibit 2). When taken with first half GDP, which clocked in at just 1.2%, growth may for now, be the more immediate concern.

Chair Powell will take the stage on August 22 in Jackson Hole, with the opportunity to address this development (which came following their July FOMC meeting), and his view of the balance of risks at this juncture. With his tenure down to 9 months, as he evaluates his legacy, he undoubtedly would like to avoid comparisons to former Chairman Arthur Burns, who famously surrendered to President Nixon’s entreaties to lower rates, and ushered in an era of runaway inflation. Chair Powell famously prepared US households for “some pain” in his speech in that same setting three years ago; he may similarly opt to channel his inner Paul Volcker again, and push back on premature celebrations over future rate cuts.

Are We There Yet?

So what is the overall takeaway from the tumultuous period just passed? One lesson is that the eventual reality has not been as bad as the initial headline—but also, it’s not over.

The market, and our portfolio managers, would certainly like to fast forward to a post-tariff world and a new Fed Chairman, and be able to re-focus on fundamentals amid a possibly less restrictive interest rate policy. But those fundamentals themselves are likely to be meaningfully impacted by shrinking corporate and small business profit margins, and from the demand destruction that may result as some portion of tariffs passthrough into end-consumer prices.

So there is quite a lot of runway left, and we believe our long-term, prudent approach to asset allocation and security selection will serve portfolios well, in what is still a very uncertain, and expensive, market landscape.

Kristian R. Jhamb, MBA, CFA

Chief Investment Officer

LEGAL, INVESTMENT AND TAX NOTICE: This information is not intended to be and should not be treated as legal advice, investment advice or tax advice. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal or tax advice from their own counsel. Not FDIC Insured | No Guarantee | May Lose Value