Can Nvidia Steady The Wobbling AI Narrative?

Posted on November 20, 2025

With Nvidia’s 3rd quarter earnings release now behind us, and with it the unofficial end of this earnings season, it might be helpful to take stock of the past few weeks of fairly volatile price action, relative to the steady rise that’s characterized the several month rally off the “Liberation Day” bottoms in April.

Volatility is Back

Since October 10, when the President threatened new tariffs (later rescinded) on China over the latest rare earths dispute, the S&P has been oscillating up or down by almost 1% daily. Also in this period has been a Fed meeting where the message was surprisingly hawkish for the upcoming December meeting (reducing rate cuts odds from a near certainty to a coin toss this morning); a 43-day, record-long Federal government shutdown; the bulk of the 3rd quarter earnings season; and lastly, and the focus of this note, some wobbling in the AI thesis.

OpenAI: Too Big to Fail?

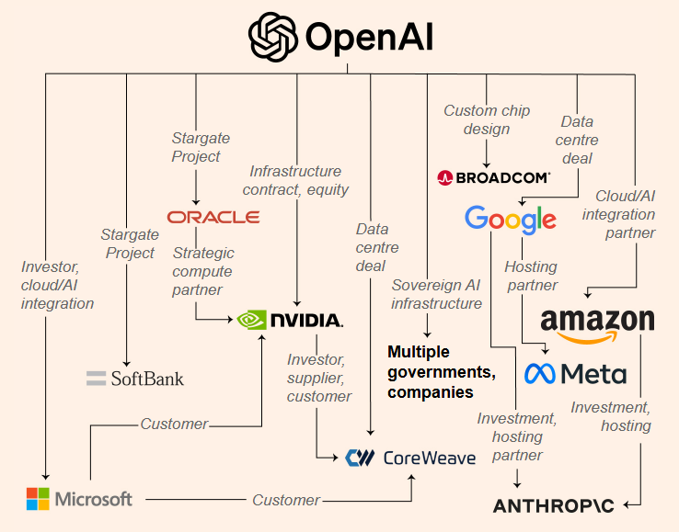

Let’s take a look at the AI ecosystem as it stands now. This diagram (Exhibit 1) is hardly exhaustive of the overall AI supply and value chain, but rather, represents the major, first level players tied up with OpenAI—which is at the epicenter, and ushered in the AI era with its ChatGPT launch in November 2022.

Exhibit 1: OpenAI—Top of the AI food chain

Source: FT, FTWM

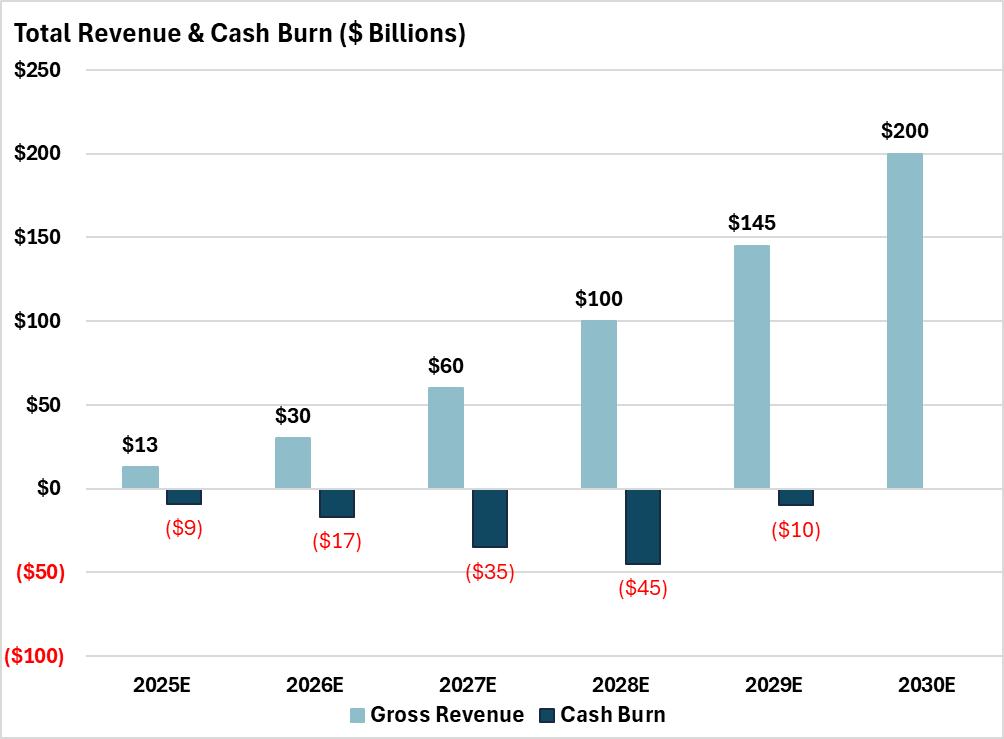

OpenAI has positioned itself, as “too big to fail”, and over the past several months has embarked on a flurry of deal-making that recalls prior frenzied periods, and the financing enablers that usually also appear (see: SPACs (’20), housing bubble (’08), tech bubble (’00)). The land grab aspect of its behavior also harkens back to past cycles, such as the early internet days (or as with Amazon)—ie. “only revenue and market share matters, we’ll figure out profits later”. There is some strategic game theory to this: the more entrenched it becomes with its partners and suppliers, the more likely it is to be bailed-out, or enabled to limp along, or re-negotiate these deals, should it fail to meet some of its hockey-stick revenue projections (Exhibit 2).

Exhibit 2: OpenAI’s Internal Projections—73% Revenue CAGR to 2030

Source: The Information, FTWM

In the past couple months alone, OpenAI has tied up with AMD, Amazon, Broadcom, Oracle, and Nvidia in arrangements that are very light on details but big on splashy dollar or gigawatt headlines. All told, it’s been reported that OpenAI has made spending commitments on the order of $1.4 Trillion, for the next 8 years. This despite the fact that according to latest internal projections, its 2025 revenue will be just $13 Billion (Exhibit 2).

Or, despite the fact that, the key bottleneck in power may make many of these “deals” undeliverable. Current estimates suggest the US stands at a 44 gigawatt power shortfall to meet the currently forecasted AI growth trajectory, just by 2028 (for reference, 1 gigawatt is roughly enough to power 750,000 homes).

Chip Industry: Boom, Bust, and 1 Supplier

How the AI revolution could be powered is another article altogether, but it’s triggered its own speculative rush in the Utility and Industrials space. The chase for turbines to co-locate with the new datacenters, is running in parallel with the chase for chips, which is also in a supply deficit relative to demand.

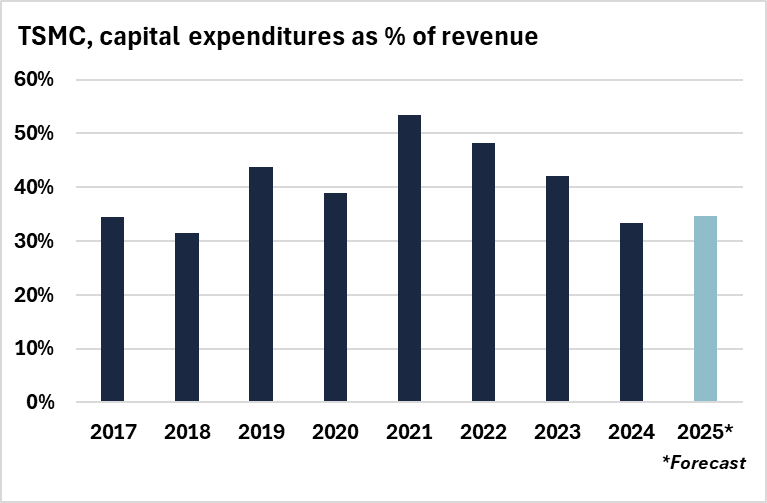

Interestingly, Taiwan Semiconductor (TSMC), which makes 90% of the world’s advanced chips (such as for Nvidia, Qualcomm, Apple, AMD, and Broadcom—who should be thought of as chip designers), is not running its own capex budget at nearly the breakneck speed as those downstream of it (Exhibit 3). When the world’s sole fabricator of these chips, is not going all-in, like its buyers are, that’s a message worth listening to.

Exhibit 3: Taiwan Semiconductor – Spending Discipline, for Now

Source: FactSet, FTWM

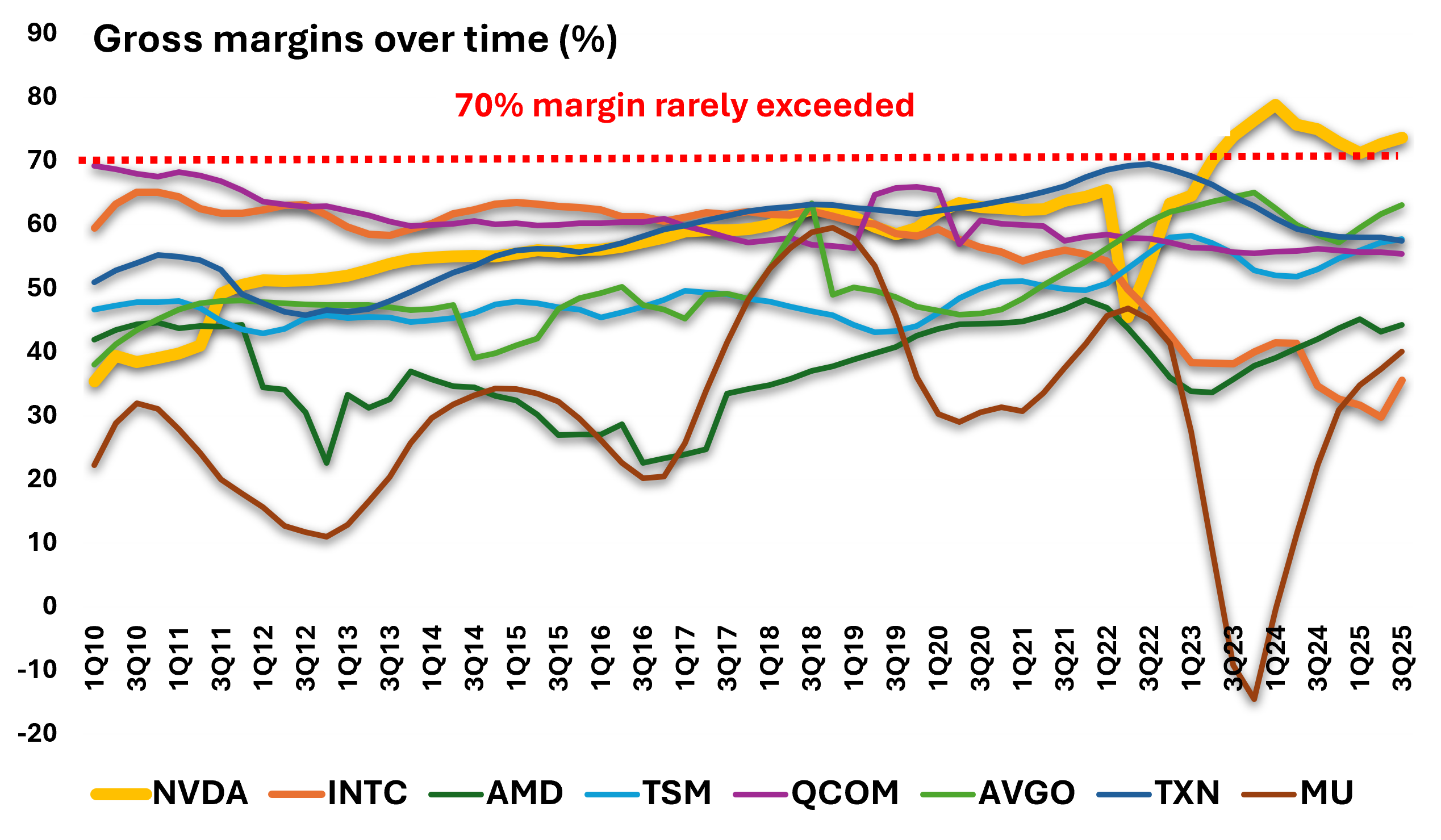

TSMC is showing restraint in adding to capacity, because fabrication facilities are incredibly expensive, slow to build, difficult to staff, and the chip industry overall is historically quite cyclical. As Exhibit 4 underscores, gross margins for chipmakers/designers over time are extremely volatile (note specifically the swings in fortune between Intel and Nvidia since 2010), but also have an own upper bound of about 70%, which Nvidia has been bouncing around since its ride to the top in 2023.

Exhibit 4: Chip Industry—Pick the Next Winner

Source: FactSet, FTWM

Nvidia may very well not remain the victor as the ‘pick and shovel’ vendor during this digital gold rush—competitors, most prominently AMD, are stepping in to provide alternative chips, as are the customers themselves—Amazon, Google, Meta, Microsoft, and OpenAI are all developing their own ASICs (Application Specific Integrated Circuits) to relieve their dependence on Nvidia and cost pressures (ASICs are dramatically cheaper per unit of compute).

In its earnings conference call, Nvidia took lengths to dismiss the naysayers and upstarts in their server market, “We run OpenAI, we run Anthropic, we run xAI… We run them all.” The passage of time will reveal that to be either well-justified confidence, over-confidence, or hubris, and the outcome will reverberate throughout this highly interconnected landscape.

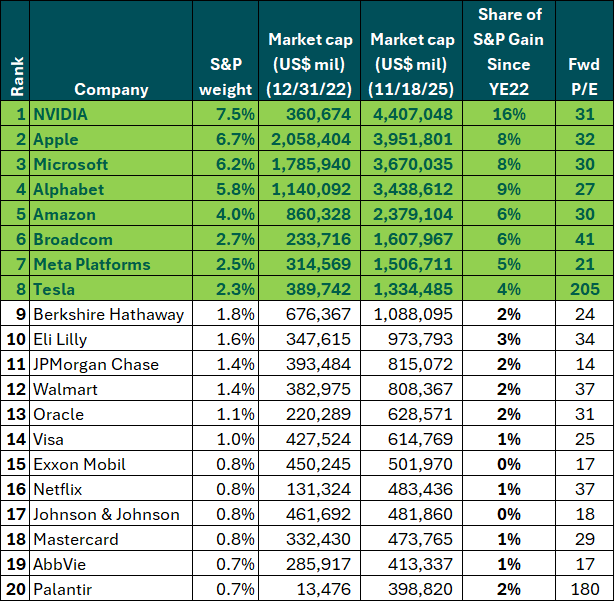

AI: Powering the Market Since 2022

It is also important to take a step back, in time and in perspective, and review the scale of the equity market moves since OpenAI’s launch in November 2022. From the end of 2022 to today, the “Magnificent-8” (Alphabet (Google), Amazon, Apple, Broadcom, Meta (Facebook), Microsoft, Nvidia, Tesla) have powered the S&P 500 up an overall 72%, of which 61% is attributable to their gains alone—with 16% solely from Nvidia (Exhibit 5).

Exhibit 5: “Concentration Risk”

Source: FactSet, FTWM

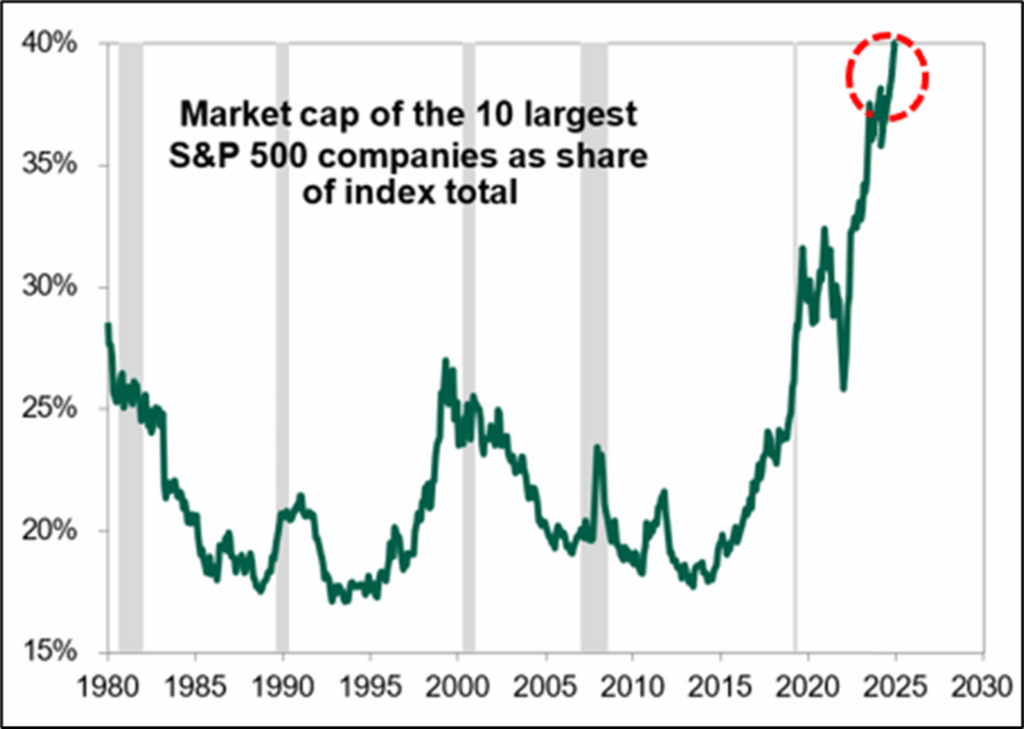

This concentration in returns has, predictably resulted in a concentration of value as well—those 8 names are now 38% of the S&P’s value. The top 10 names in the S&P, a shorthand measure for concentration, has never been higher (Exhibit 6)

Exhibit 6: S&P Concentration—This Time is Different

Source: FactSet, GS, FTWM

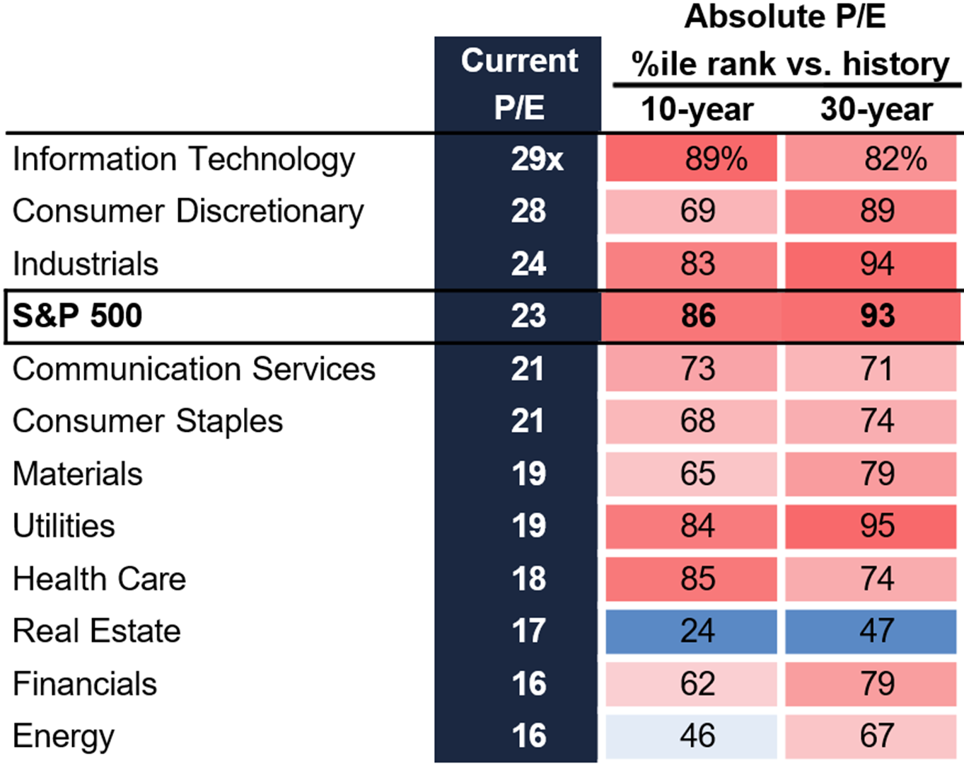

With this level of concentration of value, and concentration of risk, any cracks in the AI narrative, especially from OpenAI (which ironically, is a private company), could rapidly trigger a rethink of the projections and the valuations that are predicated on them, which are high across the board. (Exhibit 7)

Exhibit 7: Valuations—In the Red Zone

Source: FactSet, GS, FTWM

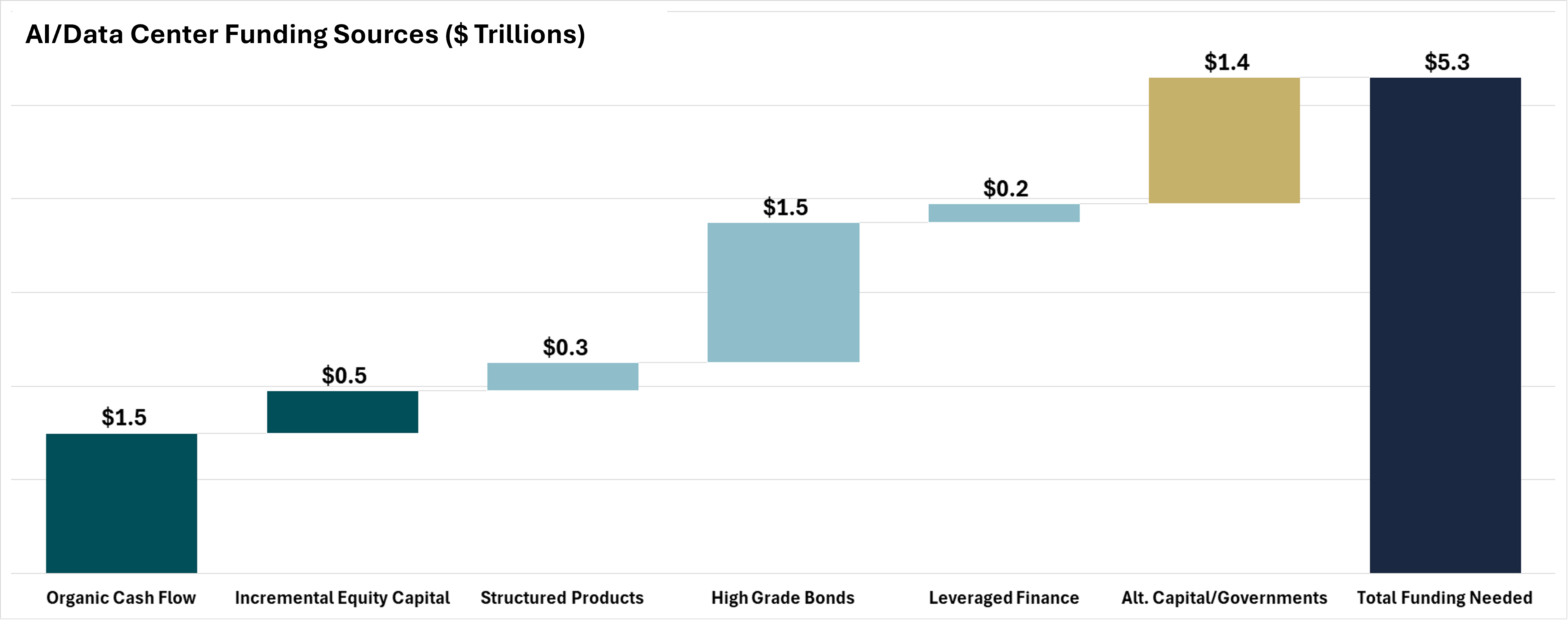

In the recent period of market volatility, the narrative appears to have shifted from “show me the spending” to “show me the ROI”, especially as the staggering scale of the aggregate spending gaps (Exhibit 8) is more appreciated by investors. No longer is AI a modest foray funded from internal cash flow; it has moved down the capital structure to debt financing, which to many market observers is usually when you need to pay close attention.

Exhibit 8: From Equity to Debt Financing—Signs of Late Cycle?

Source: JPM, FTWM

The Investment team at Florida Trust is paying attention, and while we own many or all of the names mentioned here, and others in the broader AI ecosystem, our position sizing and asset allocation are right where we prefer to be—generally lighter in these tech high flyers, with an emphasis on higher cash and bond levels.

We are hopeful for AI to bring great benefits to the economy and your investments, but after now three outsized return years, we are prepared for these and any other tremors that may come.

Kristian R. Jhamb, MBA, CFA

Chief Investment Officer